The US fiscal trajectory is unsustainable and will require resolution, but does it inevitably entail excessively high-interest rates for “longer”? We have our doubts.

The “Watch Series” is a collection of individual series such as Europolitics Watch, Inflation Watch, Real Estate watch and much more. Stay tuned for in-depth coverage of your favourite subjects.

The US fiscal trajectory is unsustainable and will require resolution, but does it inevitably entail excessively high-interest rates for “longer”? We have our doubts.

We find value in the FX space again now that USDJPY seems to have comfortably broken 150 after a bit of volatility.

As SLOOS-alike reports have come in for both EU and Japan, we have a look at the differences in credit surveys across the Atlantic, and which credit spreads to look out for in the time to come

As conditions doesn’t favour further upside in our Asian FX bets, which calls for profits to be taken.

The supply side has probably been what’s driven commodities higher in 2023, but how is the supply looking in metals and grains currently given the recent surprising momentum in for example Iron Ore?

Just as most tabloid models forecasted a near-0% chance of a recession within the next year, markets reacted in stark contrast. Can the recent broad based selloff and the following and current rally be explained by developments in liquidity, inflation, or growth?

The SLOOS is starting to improve sequentially, which bodes well for the hopes of a shallow 2024 recession.. but a wave of bankruptcies is likely still incoming, while it is hard to see credit and equity markets celebrating meanwhile

Happy Monday to everybody and welcome back to another Energy Cable. On the back of the last week’s of tension in the Middle East we thought we would do a bit of thought-provoking argumentation for a potential US-Saudi deal which we have dubbed “The Riyadh Accord”.

Last week’s rally was truly remarkable, especially considering the months of hardship that most assets endured prior. Could this be the long-awaited revenge of the longs, with short covering poised to dominate the price action in the days ahead? Dive into our analysis below to find out.

A mixed week for us with duration performing, but our equity spreads have taken a beating along with our 1 naked short. We booked some profits and added further exposure in Fixed income. Read below for our full take on the week and how we see the market in coming weeks

It’s important to ride ones’ winners, but we think it is time to cash in on these three very profitable trades. Meanwhile, we add exposure in fixed income.

The EIA demand data remains volatile and slightly out of whack with actual congestion trends. Oil demand has rebounded while new weakness is seen in transportation fuels.

Here we highlight 3 key observations from our Central Bank Sentiment tracker, with the ECB, Fed and BoJ all exhibiting interesting shifts in their language at an important policy juncture.

With central bank policy and energy having dominated FX throughout 22’, we have a look at what underlying fundamentals and correlations are telling us about the fair value of the hottest FX pairs currently.

Why should Powell abort the planned hike from the dot plot when everything is improving relative to the base case in the US economy? We are not writing off a Q1-Q2 recession, but the soft/hard evidence is not there for the FOMC members.

The quarterly refunding report will likely allow the Fed to be hawkish for longer as the liquidity outlook is decently benign, while the bond-zooka was avoided (for now). Find the details here.

Your weekly Energy Cable with thoughts on the growing correlations across natural gas and electricity in Europe and a quick JPY take

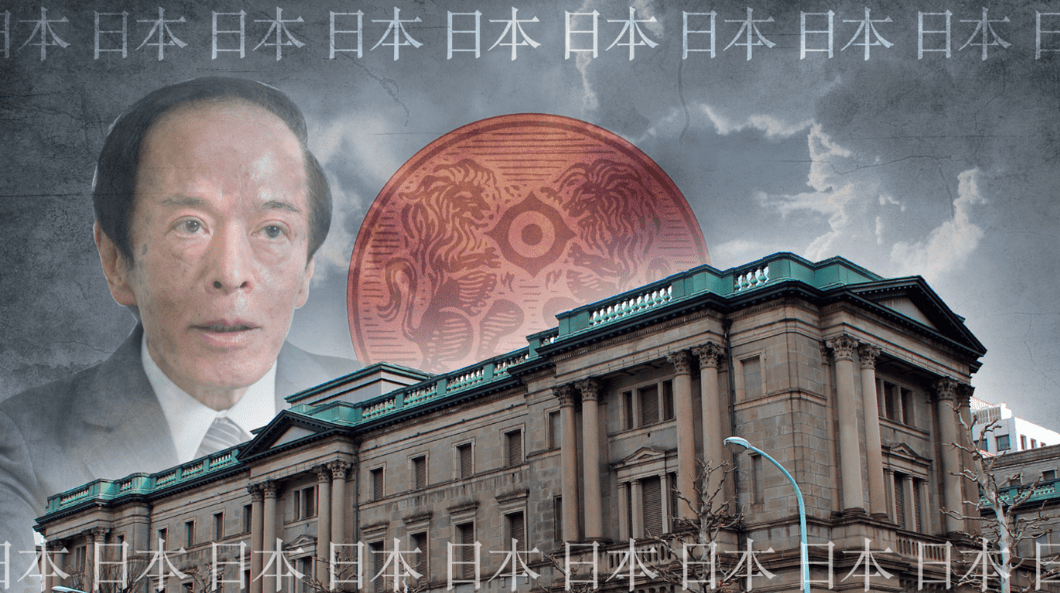

It is time for one of the most important Bank of Japan meetings in decades. Markets remain unprepared for a move, despite the pre-warning of a higher inflation forecast. Here is our preview!

These days, everything seems to be in motion, but not all at the same pace of change. Dive into our inaugural Monday edition of Positioning Watch below to discern the disparities

We remain tilted towards a positive energy performance, a steeper USD curve, but now also risk sentiment weakness and some pockets of performance in European duration. Here is why!

We see between 0.20-0.25%-points lower inflation in the Euro area than the consensus and the first evidence is already gathering in Germany. Expect EUR inflation to be below target by March-2024 at the very latest.

Inflation is likely going to drop just below 2% in Europe/Germany, but there are signs of bottoming price pressures in the IFO Survey, while the Chemicals sector keeps improving orders/inventory ratios.

There is no doubt left that the ECB has hiked for the last time, but the question is whether the doves can get the upper hand in the committee. Focus now shifts to the most important BoJ meeting in many years.

Every week we adjust the demand side data in the EIA report for the noise of seasonality and methodology issues. Our view that October would show a strong rebound compared to September has been proven correct, except in Nat Gas.

Lots of talk of “higher for longer” as rates keep jacking up. I am a beliver of a different “higher for longer” however. Read here which

All major central banks with large bond holdings from 2015-2020 are insolvent, but we are yet to see any major recapitalization of any of the large central banks. Will they come asking for capital with the worst possible timing?

US Politics is in a state of gridlock. We give our latest view on the affairs on Capitol Hill below

Today we had the Bank Loan Survey from the ECB, and the numbers say a great deal. Gloomy worries leave Euro Area banks hesitant about providing or extending credit, but, just as telling, demand is nowhere to be seen. Our main takeaways here.

We anticipate that the economic cycle will defy current market expectations in Europe. Read below to see how we place our chips

If the PPI is any guide, we will soon see the EUR inflation printing below target again, which will allow the ECB to ease since the growth picture remains lackluster as well. The Fed is not close to claiming victory compared to the ECB.