Closing our USD duration bets after Japans YCC decision and the ISM numbers

The “Watch Series” is a collection of individual series such as Europolitics Watch, Inflation Watch, Real Estate watch and much more. Stay tuned for in-depth coverage of your favourite subjects.

Closing our USD duration bets after Japans YCC decision and the ISM numbers

Trade Alert: Stopped out of our FX cyclical bet

The quarterly senior loan officer survey is out and there is both good and bad news. Supply of credit keeps worsening, while the demand for credit shows (very) early signs of life. Let’s look at the five best charts from the survey!

We have entered a macro regime where PMIs and headline inflation outpace liquidity in importance. The pick-up in Manufacturing PMIs paired with the potential higher headline inflation provides some interesting guidance for portfolio managers.

We’ve been right that EM’s would be the first to sniff out the disinflationary trend. Now we add some exposure to profit from it

The tightening cycle continues for both the Fed, ECB and now also BoJ, and that means it’s time to revisit global money trends to see what might happen next.

The central bank week is over, and that means it’s time for us to have a look at how Investors and Traders perceived the Fed meeting and how they have adjusted their portfolios in response.

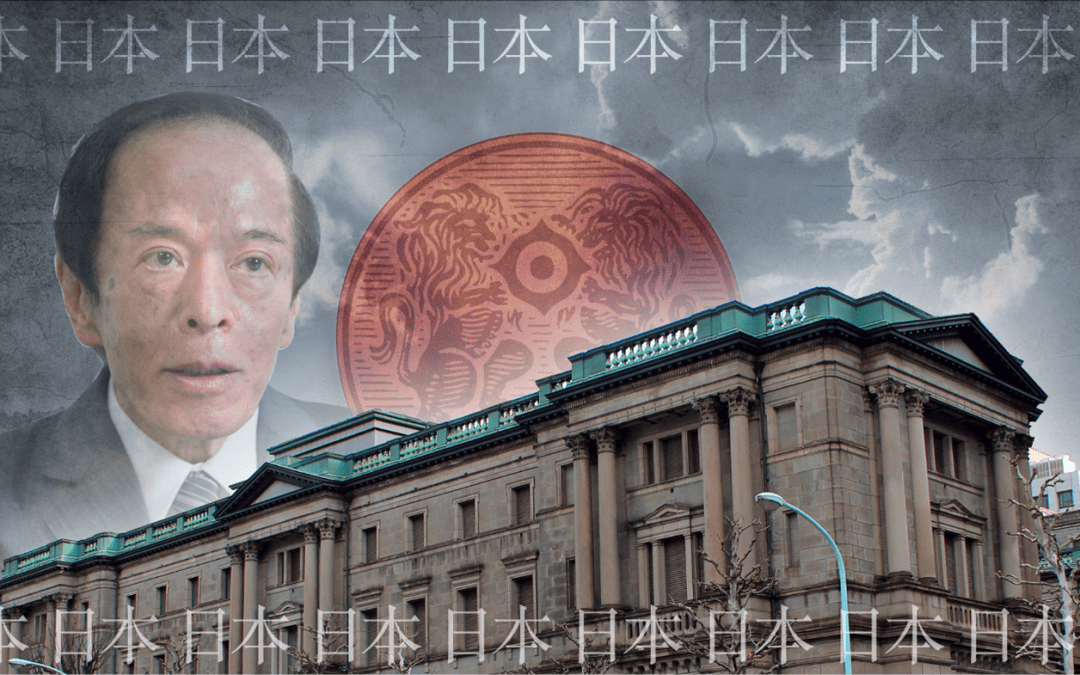

BoJ’s decision is of course the big talking point for markets this week. Our book keeps up despite some impact from Ueda’s decision- but what will it mean and how will we trade it in the coming weeks? Read our view below

The BoJ has rocked the boat short-term, but it doesn’t alter the big macro picture of Goldilocks vibes in the US economy. We see the BoJ move as a “hump” and keep our eyes on the bigger picture.

The Bank of Japan did indeed move the needle as the big spike in the short-term inflation forecast provided them with an excuse. The big question is whether the move will lead to more or less printing? And whether the packaging is dovish enough to keep markets calm?

The ECB is closer to pausing than the Fed and the clear headline mandate may allow the ECB to throw in the towel on the hiking cycle earlier than peers. Tomorrow’s inflation data is key. Here is our chart-package.

We’re skeptical of the “data-dependent” rear-view mirror approach by the FED & ECB. Refuting to provide guidance is one thing but are they listening to their crowds and acknowledging the differences?

Everything points to a 25 bps hike and then a pause from the Fed at today’s FOMC meeting so where does this leave us historically and what do we think about the outlook? Time for a Fed pause watch!

A weaker USD, a slight rebound in the Manufacturing cycle and still tight supply has re-ignited the energy space alongside the broader commodity trend. There is certainly progress for bulls now.

We add to our cyclical bets in FX space with a few idiosyncratic reasons for this position as well.

Trade Alert: How to trade the cyclical momentum in equities

If the service industry starts to fade relative to the Manufacturing sector, it may be exactly what central banks use as the excuse to pause (and eventually pivot) but markets are much more sensitive to Manufacturing PMIs.

The credit contraction is already a reality in Europe and the Q3 ECB Credit Survey confirmed that a contraction is the most likely scenario for H2-2023. There are early signs of improvement, which means that we may get an outright rebound into 2024.

It seems carved in stone that the Bank of Japan will have to revise the inflation path higher again in projections but will it be enough for Ueda to move the needle on the yield curve control? Here is our list of pros and cons and our base-case!

With everybody jumping onboard on the equity rally, we have a look at how retail investors are positioned in equities, and what surveys have to offer us on the positioning front

Xi has been punishing us this year though we have taken W shorting the CNY. We now too have closed our most profitable trade YTD. Read about it all below

With the possibility of the manufacturing sector rebounding, commodities might be in for a ride as demand increases in a tight market.

Trade Alert: Closing our most profitable trade to date

We revisit the eurosceptic case to assess whether we have let our pessimism get the better of us. Or could Euro bulls still be in peril?

Earlier this week we identified possible curtain-raisers on near-term developments in US manufacturing, and with parts of the Philly Fed Survey backing our findings, what can be expected for equities?

If we indeed get a short-term cyclical rebound, the yield curve is going to be tested. Does a hugely inverted curve rhyme with a rebound in manufacturing? Probably not. Let’s have a look at it.

Could a right-wing government in Spain follow in the footsteps of Meloni’s crusade against the EU economic framework? Tensions are high as we gear up to the all-important General Election on Sunday.

This week our primary focus is the current business cycle, where we try to figure out which stage we are in, and what outlook different asset classes are pricing in. Today’s edition of ‘5 Things We Watch’ is no exception.

USD weakness paired with an uptrend in cyclical currencies sounds like the perfect rebound cocktail, but can FX markets rightfully reveal turning points in the economic cycle? Let’s have a look at the current pricing and the historical evidence.

The sudden weakness in the USD adds to the list of positives for energy and commodities overall. Is the best possible bull setup now in place? We take a look.