The debt ceiling is now in force in the US. Is this judgment-day-sounding occurrence really worth all the fuzz, and if it is, what are the ramifications for financial markets?

The “Watch Series” is a collection of individual series such as Europolitics Watch, Inflation Watch, Real Estate watch and much more. Stay tuned for in-depth coverage of your favourite subjects.

The debt ceiling is now in force in the US. Is this judgment-day-sounding occurrence really worth all the fuzz, and if it is, what are the ramifications for financial markets?

The US debt ceiling will be hit today, but it is not per se a particularly interesting day. The interesting thing is how the US Treasury behaves in coming weeks in months because of it. Remember to watch BoJ-governor Kuroda in Davos. He may have a goodbye message up his sleeve.

Every Wednesday our Head of Research, Andreas Steno, goes through the 5 most important themes/charts in global macro right now and how we assess them. Enjoy!

While liquid markets are still trying to make up their minds on whether to rise from the ashes of H2 2022 or continue the downward trajectory, I think it is due time we put the real estate markets under the scrutinous loop once more.

We have taken a look at technicals in the oil market. Is it voodoo or magic? We also update our price signals for oil and natural gas. Time to buy? Enjoy!

On Thursday, the U.S. hits its 31.4 trillion-dollar debt limit. If Congress fails to raise or suspend the limit, the U.S. risks defaulting on its foreign debt with global economic ramifications. So naturally, Steno Research is launching a new ‘U.S. Debt Countdown’ watch series to keep tabs on when the U.S reaches the magic ‘X Date’: the day when The Treasury runs out of ‘extraordinary measures’ to postpone the worst-case scenario, and must succumb to default.

It is a BIG week in Japanese central bank history with widespread speculation of another increase to the trading range of 10yr JGBs in the yield curve control program. More than 35 bps are priced in, but will BoJ fail to deliver?

Each Saturday we provide you with the updated positioning across asset classes and highlight the anomalies we find. Are you leaning the same way as the crowd? Check it out here.

What is cheap and what is expensive in equity space? We have taken a look across sectors, geographies and styles in equity space. Here is what is cheap and what is expensive.

Inflation printed right on consensus despite another jump in shelter costs. Several goods categories cooled quicker than anticipated by many. This is net/net a dovish report after all. USD remains a sell.

Every Wednesday, our Head of Research Andreas Steno, goes through the 5 most important themes/charts in global macro right now and how we assess them. Enjoy!

The world’s largest importer of Crude oil is getting back online, but is a reopening per se bullish for energy? Not necessarily. China prepared for the reopening and the Lunar New Year will dampen demand.

Welcome to the second edition of “The Energy Cable”. Today we will assess the Chinese reopening and the ramifications for energy markets. For now, it seems more likely that metals will surge due to the reopening than oil. Here is why!

It is now that time of month again. As economists anxiously await the coming CPI-print, we will in this ‘preview’ turn to our charts in an effort to align expectations according to select indicators.

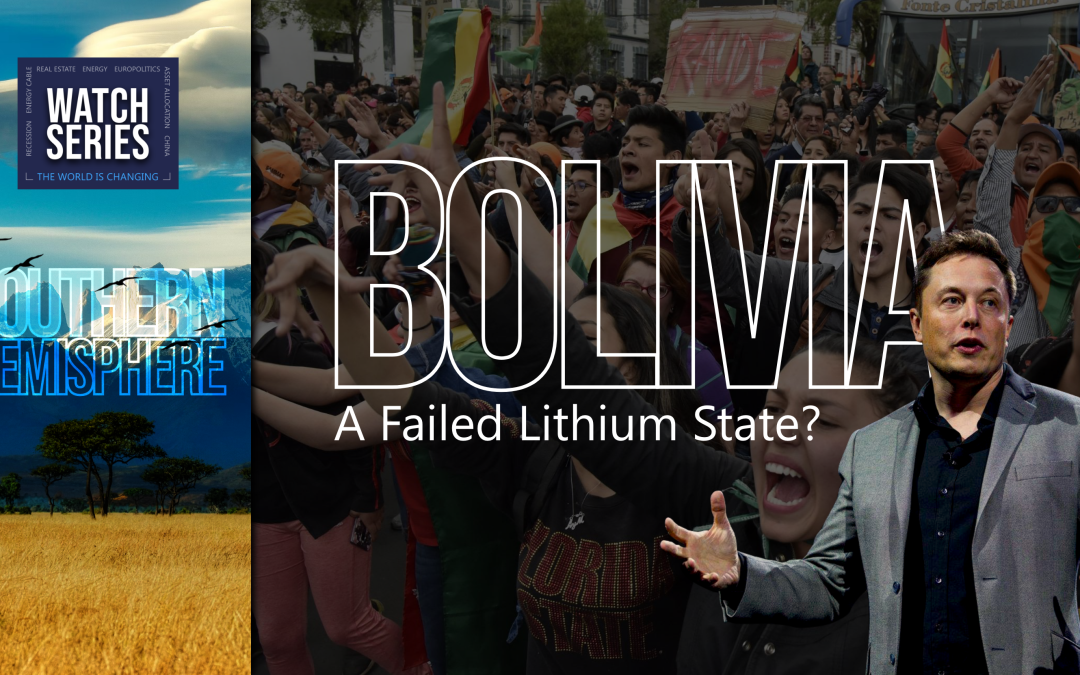

At the dawn of the EV-revolution, Bolivia is at risk of being the first failed lithium state. Is Elon Musk to blame? Find out in this article, where I also explain why Bolivian lithium is still a good bet for investors.

China is de facto reopening by now as we rightfully forecasted a few months back, but is a reopening equal to good news straight away? Not necessarily. Here is our playbook for the Chinese reopening.

12 years of infighting in the Conservative party has trapped Rishi Sunak in a doom-loop between economic crisis and a defeatist Tory MP group. Will the 2024 general election clear the path for reform?

US CPI printed at 7.1% – smack dab at our forecast – but it is not necessarily a signal to buy risk assets. Margins increased when inflation was hot. The opposite will happen now.

Fair warning: anyone believing that the UK is approaching more EU alignment has grossly underestimated the depths of mutual animosity and distrust that’s currently splitting the Tories from within

The biggest interest rate shock in several decades ought to challenge the Real Estate outlook. Since housing famously is the business cycle, what is the 2023 outlook for housing?