Money is flowing towards safety, but the foundation beneath the market remains solid, with no signs of a downturn yet. In light of the geopolitical events we assess our Portfolio below

Money is flowing towards safety, but the foundation beneath the market remains solid, with no signs of a downturn yet. In light of the geopolitical events we assess our Portfolio below

As we review the events of this eventful week, it unfortunately appears to conclude with a tragic development, as we find ourselves reporting on the potential beginning of yet another conflict.

The EIA report indicates demand drop, Non-farm payroll signals a soft landing, and we’ve taken a spread trade loss. We’re in challenging waters. How should we position ourselves, and how are we doing? Read our weekly Portfolio review below

Oil prices have collapsed in recent days undermining one side of the USD/Oil wreckingball. Good news for EM’s generally? We offer our takeaway below and how we prefer to play it

We’ve taken a massive WIN in recent weeks, but the markets are precarious here after blood on the street as seasonality shifts. Is there a final surge before the impending collapse?

When things seem to be spiraling downwards, trades that capitalize on relative weakness often present favorable risk-to-reward opportunities. We’ve recently entered such a trade ourselves

The Fed projects higher rates for longer, while oil production cuts persist. How do markets play the “Higher for longer and Lower for longer” ? Read our weekly report below

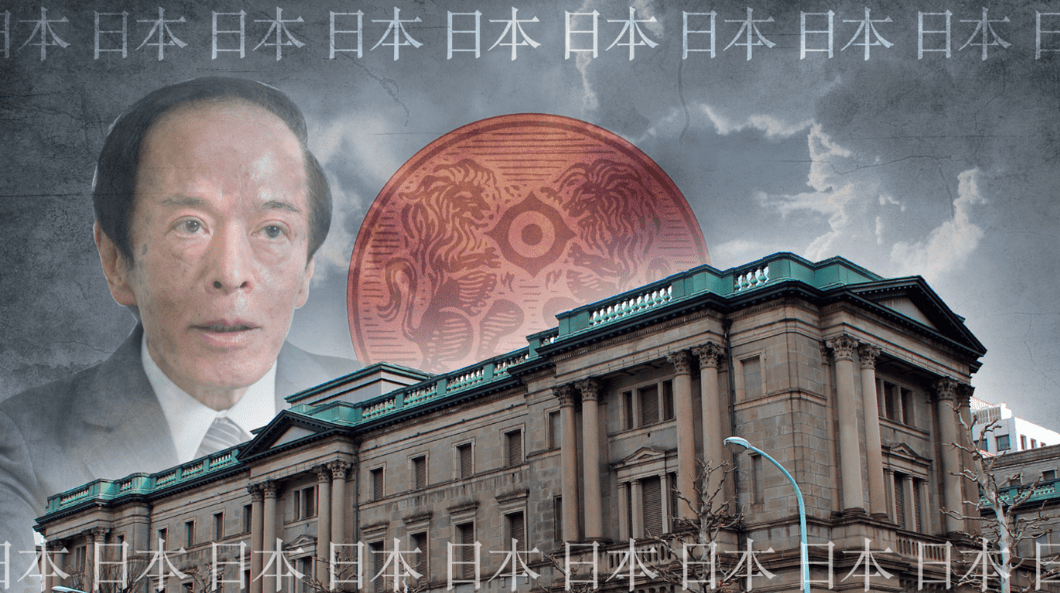

Ueda has got the situation under control and managed to orchestrate a whole string of positive market developments on the back of his monetary policy mix. There are no major reasons to change course. Steepen the JPY curve slowly, while accommodating the short-end.

We have argued that risks of a more rapid disinflation in Europe are going under the radar. But as we get poor job opening numbers from the US, how do we assess the growth trajectory of the EZ and how will the ECB likely act?

A lot of volatility and plenty of aspects to digest after a red week in markets. But how have positioning and sentiment moved? Read here to for our view

Plenty of bets in LatAm carry trades unwound this week on the back of BoJ YCC tweak. But perhaps the LatAmsphere has a USD winner short term?

The central bank week is over, and that means it’s time for us to have a look at how Investors and Traders perceived the Fed meeting and how they have adjusted their portfolios in response.

We have been bullish on Brazil for months and got the market and timing right. But what about Brazilian stocks? Could they prove to be a buy here?

Many have profited from MXN carry in the first half of 2023. But is there more left to squeeze out or is it running on fumes? We give our take here and assess the structural patterns at play in Mexico in relation to recent performance and the geopolitical climate.

Volatility has been detrimental to many books this week which too is reflected in some of our positions and it appears that diversification is gaining increased significance given the resurgence of volatility. Traders who are not paying attention here will pay for it involuntarily

Gold has enjoyed a revival on the back of inflation and monetary expansion. But what happens when the tailwinds disappear?

Economic data keeps surprising us positively, and markets are starting to believe that a soft landing is the base case. That’s at least what positioning data is telling us.

Follow along as we keep you updated on our live portfolio and how we view the world allocation-wise every week!

2021 will be remembered as a great policy error year at the FED and the ECB. But other central banks saw the inflation coming. Will they be in front of the curve again in 2023?

Positioning will be KEY to watch as political risks and tensions mount. We offer our view on the data for the past week as Yevgeny Prigozhin marches on Moscow.

With today’s recessionary PMI numbers, hawkish central bank rhetoric and a shift in price action, there are good reasons to believe that positioning might flip from now on, as investors will likely prefer bonds over equities.

In this current cycle, India has emerged as a favorite among emerging market investors. But are we seeing a bubble similar to Japan in the 1980s? Or will India be successful in replicating the success of China? While we maintain a positive outlook – India counterintuitively is not cheap.

We have not been shy about our euro skepticism lately (to say the least) but as we now trade it, I thought it only appropriate to add some broader context to it. The way I perceive and understand the Eurozone I owe much to the influence of Edward Hugh who is sadly not with us anymore. I had him in mind writing this piece

Our portfolio is green and we are content with the returns despite a few bad apples in the mix. The market environment is uncertain, and we anticipate increased selling pressure is imminent once the tightening gets going. Risk management and diversification are crucial in this setup. See our weekly performance evaluation for here details

As the Lira is trying to outcompete the depreciation of the Venezuelan Bolivar and the volatility of dogecoin, we provide our view and assessment of the near-term impact of Erdogan’s narrow victory. Markets were not impressed by the outcome but will the skepticism remain the prevailing narrative?

The USD is on the move and as per usual, repercussions are felt across the financial markets. Disinflation seems to be pretty across most of the globe and China is now actively exporting lower prices again. Position accordingly.

The purchase of TLT looks attractive from both a technical, tactical and fundamental perspective at this juncture. May inflation will look soft across the globe.

While commodities traders have positioned themselves for the inevitable recession, some equities and FX are living their own lives, celebrating the recent debt ceiling optimism and better than expected GDP numbers. Find out if you have chosen the correct bets in this week’s edition.

Having commenced this series with a bullish perspective on Brazil, it has now been approximately two months since my initial analysis. As I reassess the situation, I contemplate whether the trade is losing momentum or if there are still untapped profits to be seized.

When the dust settles on this deposit crisis, banks will have to buy more bonds as financial authorities are likely to tighten LCR rules and ask banks to re-calibrate modeled outflows from corporate deposits. Lower for longer in core rates, while Italy is at risk?